Cryptocurrencies: the gold standard of the 21st century?

By enabling the creation of a distributed database in which changing historical records is technologically infeasible, blockchain technology gave rise to cryptocurrencies. Although at the beginning they were a niche topic associated with the "dark web", they quickly gained immense popularity and increased their value at an incredible pace. Today, their role continues to evolve and their applications can range from project financing to complementing cash.

With expanding use of cryptocurrencies, it is worth systematizing them in terms of the issuer, because this is the factor that decides or will largely decide about their use. The main categories include traditional "network" cryptocurrencies, private tokens and Central Bank Digital Currencies.

Network cryptocurrencies

The first category is currently the most common, with examples including names such as Bitcoin, Ethereum, or Dash. The current trend is their seemingly never-ending increase in value. Regardless of whether it will take place in the future, there is no doubt that many users of cryptocurrencies use them as a form of payment ensuring anonymity, speed and low transaction costs. Due to improvements in algorithms, a dynamic increase in the number of active cryptocurrencies is also observed.

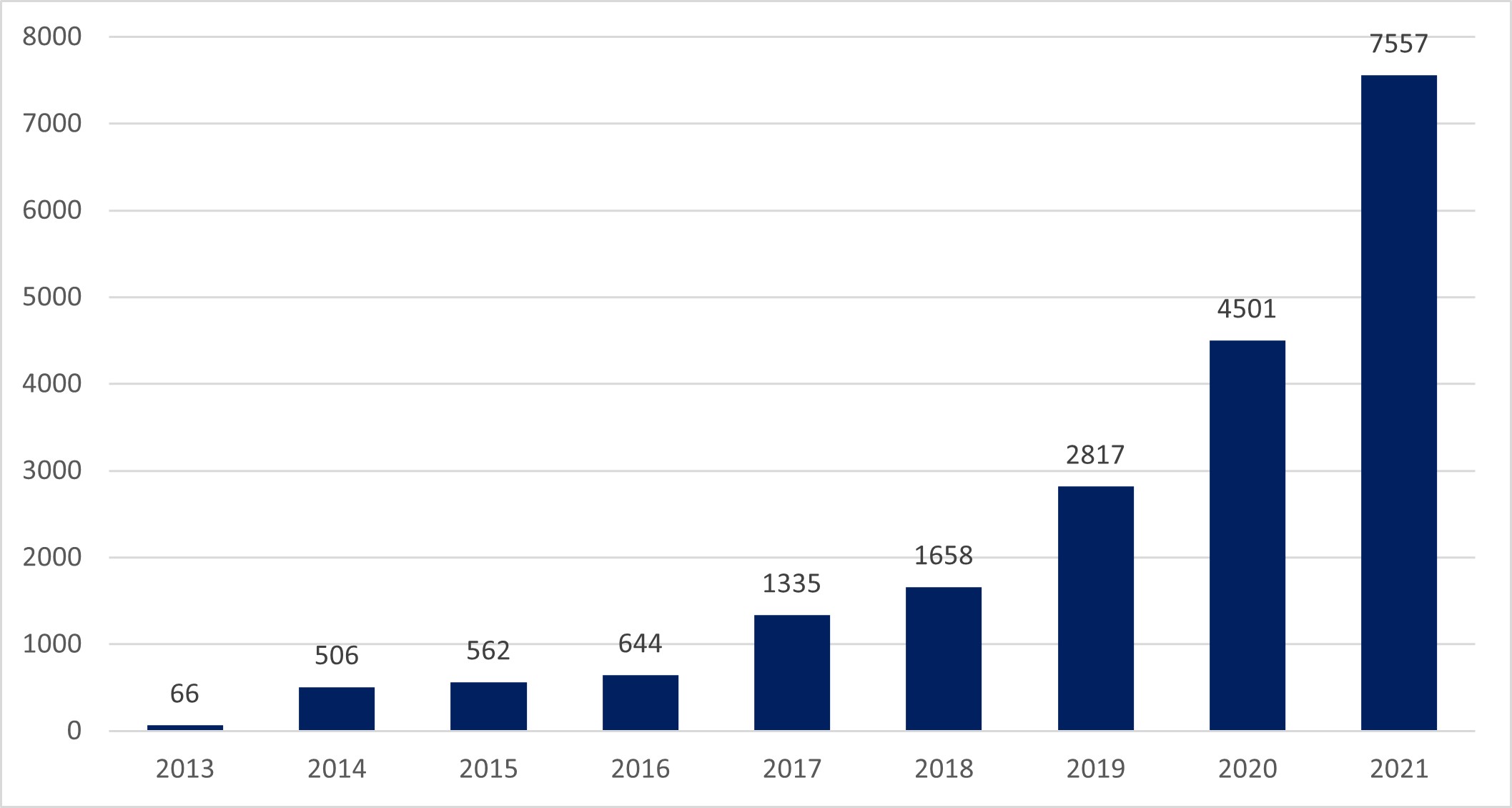

Number of active cryptocurrencies

Source: Statista, 2021

A trend that may bring changes to the cryptocurrency market may be the upcoming Metaverse, in which digital tokens will be used as a medium of exchange. For example, the value of the SAND cryptocurrency connected to the metaverse The Sandbox has increased more than 6 fold to $5.24 since the beginning of October due to increased public interest because of the change of the name from Facebook to Meta. Other cryptocurrencies related to the novel reality are MANA or AXS. However, it remains under the question mark whether the developers of Metaverse will be able to encourage users to make transactions with highly volatile tokens.

Private tokens

This category includes cryptocurrencies issued by private entities, such as banks, corporations or even start-ups. The goals of creating a private cryptocurrency can be different. The most obvious reason is the reduction of the transaction time and costs in settlements with customers or branches abroad. Thanks to their independent solution, corporations are not exposed to the risk of volatility of the popular cryptocurrencies. An example of a private token can be JPM Coin created for the needs of J.P. Morgan.

Another application of private tokens is financing through an ICO - Initial Coin Offering. An ICO is the sale of specially created tokens to investors in exchange for traditional currencies or cryptocurrencies. The proceeds from the sale are used to fund the development of the project, and the tokens give investors a number of benefits depending on the issuer, such as priority in the purchase of goods or share of profits. Most often, however, the issued token becomes a new cryptocurrency itself that can capital gains (or losses) to investors by changes in its value on the secondary market.

Despite the fact that so far ICOs has been associated with projects from the world of cryptocurrencies, it is potentially applicable to completely different industries as a form of crowdfunding. The catalyst for the development of this form of financing may be its regulation, as it would allow banks to provide advisory services in the field of ICOs, which would lead to its popularization. Regulation would also protect investors from frauds.

Central Bank Digital Currency

Central Bank Digital Currencies (CBDCs) have become the subject of research of central banks across the globe. Due to the early stage of development, it is difficult to distinguish their universal features. However, it is known that unlike current electronic money, CBDC holders would access their accounts directly at the central bank, which would eliminate the need for intermediaries to participate in the transactions. Moreover CBDCs are not necessarily based on blockchain technology, because it allows greater state control over the currency.

The digital yuan (e-CNY) is currently the CBDC at the most advanced stage of development. The People's Bank of China began its development in 2014, at a time when Bitcoin was barely known. Since October 2021, a pilot program has been underway, under which 140 million people set up a digital wallet in the first month of the programme, and the value of the transaction exceeded CNY 62 billion ($9.7 billion). The People’s Bank of China attitude towards the digital yuan can be considered to be rather expansive, since it is not possible to pay interest to e-CNY holders. Also, there have been signals that units of digital yuan will have its expiration date, with intent of boosting consumption. Finally, the digital yuan is designed to be only exchanged to fiat yuan by banks.

The introduction of CBDC is also being considered by the European Central Bank. In July 2021, it announced the launch of a 2-year pilot program to investigate security, efficiency and the feasibility aspects of developing a digital euro. The Federal Reserve Bank is also considering digital options, but according to its chairman J. Powell, "the right decision should be made, not a quick one".

A full implementation of CBDCs would entail a series of socio-economic changes. First, this solution raises concerns about the anonymity of the transaction. For example, one of the assumptions of the digital yuan is "controlled anonymity", which means that despite the theoretical anonymization of the system, for example, the police would have access to the data. Moreover, from an economic point of view, a central bank would have access to new unconventional monetary policy measures, such as a uniform deposit rate. Another unconventional policy could be the "helicopter drop", that is, adding a certain amount to stimulate aggregate demand and fight deflation. Ultimately, digital currencies would mean eliminating the risk of "bank runs" by removing the partial reserve system, which would also improve the stability of the financial sector in times of crisis.

Conclusion

Cryptocurrencies are no longer just alternative investments. This solution can be a private alternative to state money, a form of crowdfunding and a complement to the yuan, euro or dollar. The wide range of applications, despite the benefits, may also raise a fundamental problem - in what direction we want this new technology to develop. For this reason, a public debate about the values we want to preserve is necessary, so that new digital currencies do not become tools of surveillance and control.

Bibliography:

Boston Consulting Group, 2020. ‘How Banks Can Succeed with Cryptocurrency’. https://www.bcg.com/publications/2020/how-banks-can-succeed-with-cryptocurrency

Cox, J., 2021. ‘The Fed is evaluating whether to launch a digital currency and in what form, Powell says’ CNBC News. https://www.cnbc.com/2021/09/22/the-fed-is-evaluating-whether-to-launch-a-digital-currency-and-in-what-form-powell-says.html

Deutsche Bank, 2021. ‘Digital yuan: what is it and how does it work?’ https://www.db.com/news/detail/20210714-digital-yuan-what-is-it-and-how-does-it-work

European Central Bank, 2021. ‘Eurosystem launches digital euro project’ https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html

Osowski, D., 2021. ‘Po zakazie bitcoina ta cyfrowa waluta jest hitem w Chinach’ Rzeczpospolita. https://cyfrowa.rp.pl/blockchain/art19072271-po-zakazie-bitcoina-ta-cyfrowa-waluta-jest-hitem-w-chinach

Statista, 2021. ‘Number of cryptocurrencies worldwide from 2013 to November 2021’. https://www.statista.com/statistics/863917/number-crypto-coins-tokens/

Finished projects and investment transactions

Million Euro arranged capital

Customers and partners

Contact us

If you have questions related to our company or services that we provide, please contact us.

Plac Trzech Krzyży 10/14

00-535 Warsaw, Poland

office@dfcm.eu